Trends in Remote Work: Will We Still Work from Home After the Pandemic?

In the first half of 2020, remote work emerged as a common solution to companies’ desire to remain productive while minimizing employees’ exposure to COVID-19. However, amid rising vaccination rates, the share of employees working from home is regressing towards pre-pandemic levels. Was the spike in remote work a temporary solution to a temporary problem, or has the pandemic prompted a permanent shift in how we work? RDN analyzed data on remote work from the US Census Bureau and the Bureau of Labor Statistics (BLS) to assess where we may be headed.

Where We Are

Prior to the COVID-19 pandemic, the American Community Survey (ACS) showed that remote work rates had been increasing over the last decade in the United States.[1] Between 2010 and 2019, the share of the workforce working remotely grew on average 0.16% per year. As of 2019, 5.7% of workers worked from home.

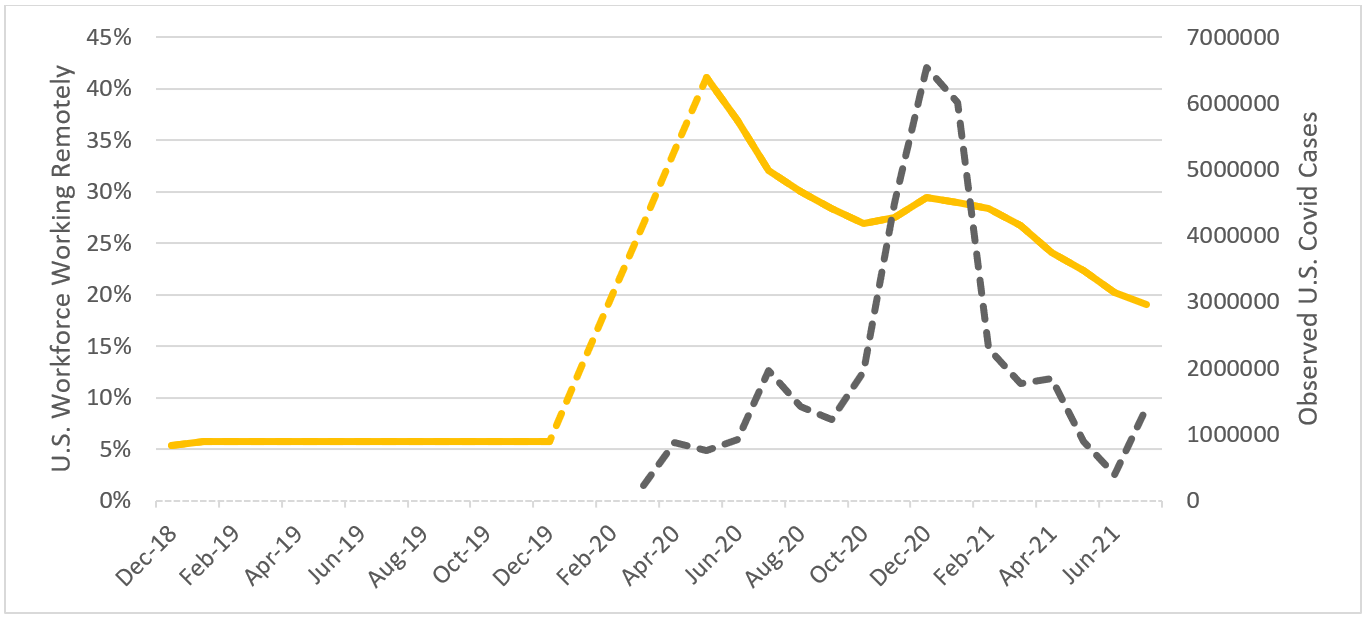

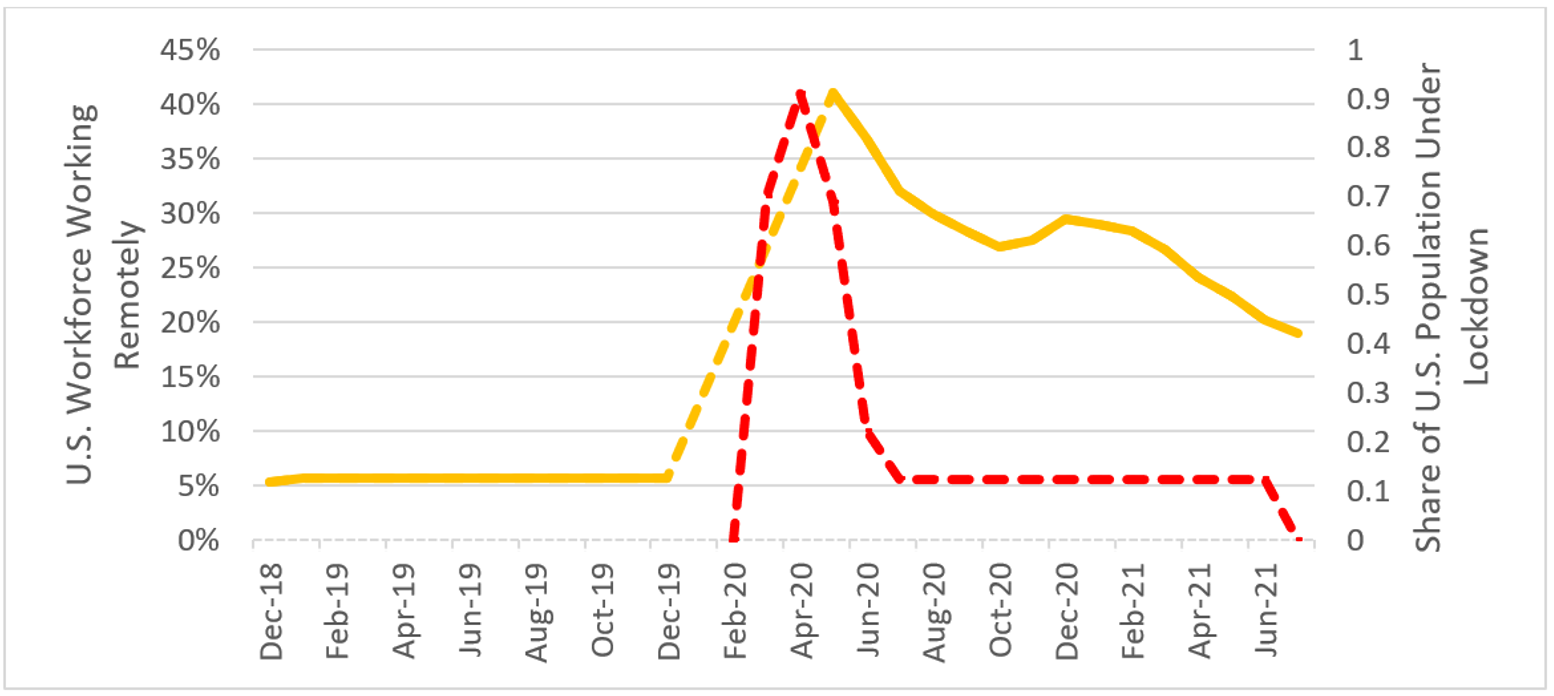

Figure 1 charts the total percentage of the U.S. workforce working remotely from November 2018 to June 2021 compared to the total reported COVID cases in the U.S. The monthly data in 2018 and 2019 are based on the ACS. (Because the ACS is conducted annually, we assume the same share of remote work for every month in the same calendar year.) In contrast, the data for May 2020 to June 2021 are from the Bureau of Labor Statistics (BLS), which began tracking the effects of COVID-19 on remote work in May 2020. Values for January to March 2020 are interpolated to connect the two series assuming a constant month over month increase. While there are some important differences in how ACS and BLS define remote work, we believe they are comparable for the purpose of evaluating broad trends. Figure 2 charts the same remote work time series data but compared to the total share of the U.S. population under lockdown orders issued by their state or municipality.

Figure 1. Share of Employees Working Remotely in the U.S. and Observed U.S. Covid Cases, Nov 2018-June 2021

Sources: American Community Survey (ACS); Bureau of Labor Statistics (BLS); Center for Disease Control and Prevention (CDC); and Robert D. Niehaus, Inc.

Figure 2. Share of Employees Working Remotely in the U.S. and Total U.S. Population under Lockdown Orders, Nov 2018-June 2021

Sources: American Community Survey (ACS); Bureau of Labor Statistics (BLS); U.S. Census Bureau; New York Times; and Robert D. Niehaus, Inc.

In early 2020, as COVID-19 began to dominate headlines and the nation braced for lockdown measures, remote work surged. As of May 2020, over 40% of US employees worked remotely.[2] That’s over seven times the share of employees that worked remotely in 2019. It is worth noting, however, that this sharp increase was caused by a combination of factors. While many office employees were able to transition to remote work, those who could not work remotely, such as food service and hospitality workers, were forced out of the labor market during the lockdowns. As a result, the share of employees working remotely increased because both the numerator (number of employees working remotely) increased, and the denominator (total employees) decreased.

The share of US employees working remotely declined to 27% by October 2020 as COVID-19 cases fell, unemployed workers returned to the labor market, and parts of the U.S. economy transitioned back to more “normal” work arrangements, albeit with COVID-19 protection policies in place (i.e., masks, frequent handwashing, etc.). The share of US employees working remotely increased a couple percentage points between October and December 2020 during the pandemic’s second wave, but the rate has since continued to decline. The pattern suggests a direct, but evolving relationship between risks to public health and the share of employees working remotely. Government and private-sector policies that affect remote work continue to adapt in the face of uncertainties, such as future vaccination rates and the impacts of the more contagious Delta variant. For now, the share of employees working remotely is trending downward, but many suspect that the pandemic will accelerate a longer-term shift to remote work that was already underway.

Looking Forward

A survey conducted in July 2020 by Gartner, Inc. suggests that 80% of company leaders in the United States plan to extend remote work access (whether full-time or a hybrid variation) for their employees after the pandemic. Moreover, in a July-August 2020 survey from Mercer, an HR consulting firm, 94% of executive respondents indicated that productivity has either remained unchanged or increased compared to before the pandemic. However, nearly a third of executive respondents in the Gartner survey indicate that the lack of corporate culture is a concern when working remotely. This division highlights the tensions underlying remote work’s uncertain future post-COVID.

After the initial economic shock caused by the COVID-19 pandemic lockdowns, economists were asked to predict the shape of the recovery: “check mark,” “swoosh,” or “k-shaped.” Here we explore similar questions as applied to the topic of remote work. Will the share of employees working remotely continue to decline to the “old normal,” i.e., pre-pandemic levels, or will it level off at a higher “new normal” where flexible working arrangements become the norm for certain industries? Post-COVID, will the share of employees working remotely grow at the same rate as it did pre-COVID, or will new technologies, economic forces, and cultural attitudes push the growth rate higher?

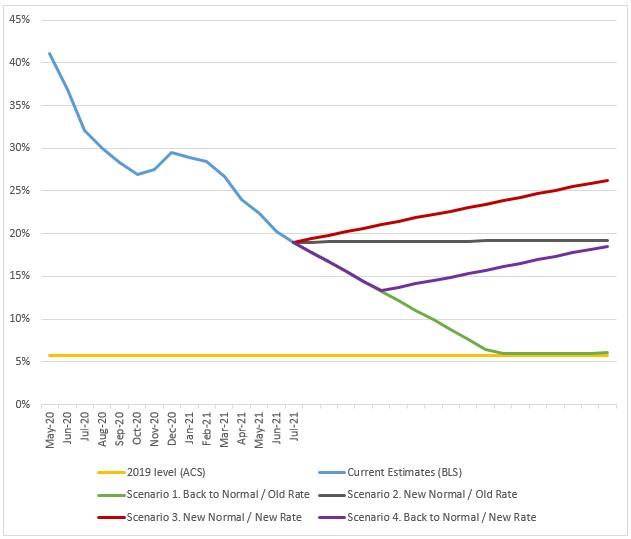

Figure 3 charts four general scenarios for the future of remote work in the US. Each colored line after June 2021 shows a potential path for the share of US workers working remotely going forward.

Figure 3. Potential Scenarios for the Future of Remote Work

Scenario 1: Back to Normal with Old Rate of Growth

The green line charts the scenario that suggests as COVID dangers subside, remote work rates decline as well. This trend would continue until remote work rates equalize to pre-COVID rates based on ACS data. However, because many workers enjoy working remotely and their productivity remains high, it may be difficult for companies to demand workers return to the office full-time. We do not believe this scenario is likely.

Scenario 2: A New Normal with Old Rate of Growth

The gray line assumes that the share of employees working remotely grows by the pre-COVID rate of 0.16% annually going forward. Employers will have to offer competitive perks to entice new employees and retain current ones who prefer a full-time or hybrid variation.

Scenario 3: A New Normal with New Rate of Growth

The red line describes a scenario where remote work becomes standard in certain industries and locations, like the technology sector in the San Francisco Bay Area, then permeates through other industries and regions at a faster rate than it did pre-COVID. However, given that nearly a third of company leaders are concerned with maintaining their corporate culture, we can likely expect a less drastic shift in the rate of remote work. The downward trend witnessed in 2021 suggests that a balance between maintaining a company’s culture and new adaptations of remote work have yet to equalize.

Scenario 4: Back to Normal with New Rate of Growth

The purple line depicts what we believe is the most likely outcome. Businesses would retain a portion of the corporate culture that they built throughout the pandemic years while recognizing and embracing the flexibility and productivity that remote work has to offer. As the danger from COVID subside, remote work rates continue to decline as former workers in industries that rely on face-to-face interactions re-enter the labor force. Eventually the rate reaching an equilibrium and levels out a higher rate than before COVID because the companies that embraced remote work continue to do so. The benefits of remote work, such as increased productivity and employee satisfaction, incentivize other employers/industries to follow suit, which becomes easier over time due to cost reductions and quality improvements in the technologies and infrastructure that facilitate remote work.

[1] U.S. Bureau of the Census, 2021. American Community Survey Data. Means of Transportation to Work by Motor Vehicles Available for Workplace Geography, downloaded from the agency website. July. Suitland, MD.

[2] U.S. Bureau of Labor Statistics, 2021. Labor Force Statistics from the Current Population Survey, downloaded from agency website. July. Washington, DC.